Year-End Giving Tips and Deadlines: Your Guide to Smart Charitable Giving

November 27, 2024

As the year draws to a close, December often becomes a whirlwind of travel, holiday events, and last-minute tasks. Amid the busy season, year-end giving presents a unique opportunity to give back. Whether you work with a tax advisor or prefer to manage your giving on your own, understanding key year-end strategies can help you make the most of your charitable donations and tax benefits.

Our team at the Community Foundation of Northeast Iowa is here to support you every step of the way. As you plan your gifts, be sure to keep our upcoming deadlines in mind. Below are some year-end giving tips and strategies, along with important reminders to ensure your donations count for 2024.

Year-End Giving Tips and Strategies

1. Consider the Standard Deduction Impact

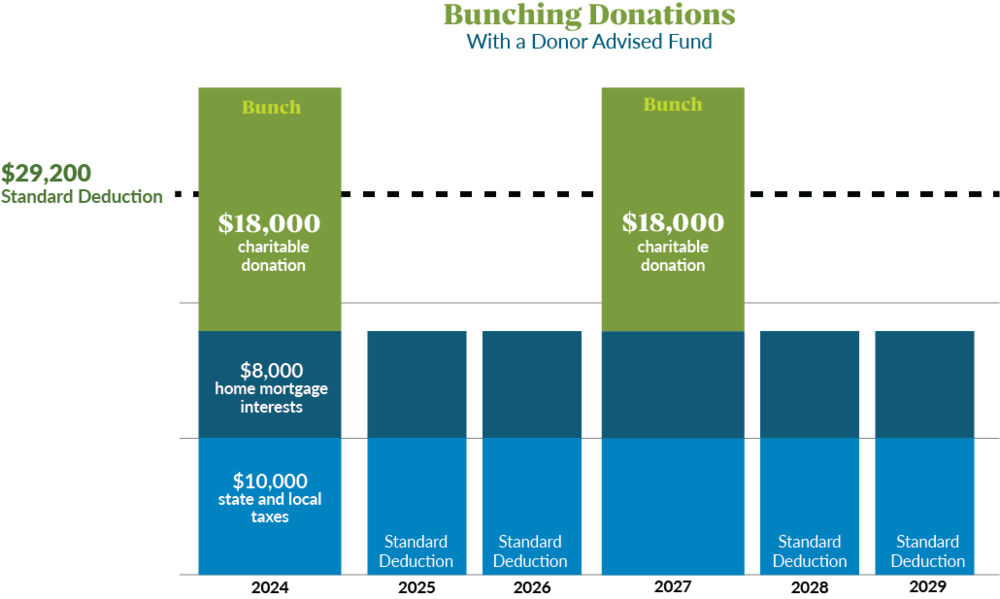

In 2024, the standard deduction has increased to $14,600 for single filers and $29,200 for married couples filing jointly. While this offers tax relief for many, it also sets a higher bar for those who itemize their deductions. When planning your year-end charitable giving, keep these numbers in mind as they can affect how much you need to donate to exceed the standard deduction threshold. If you're unsure how to approach your giving, it’s always a good idea to consult with your tax advisor for personalized advice.

2. Bunching Donations: A Strategy to Maximize Your Giving

You may benefit from “bunching” or pre-funding your giving with a Donor Advised Fund if you have a particularly high income this year and your total deductions are at or under the standard deduction amount. This giving strategy reduces your taxes by combining multiple years of donations into one current-year gift that surpasses the standard deduction threshold, allowing you to receive maximum tax benefits for your charitable contributions.

Although you will not make charitable contributions each year using this strategy, you can still support your favorite charities on “off” years. The assets in your Donor Advised Fund will be available to you so you can make grant distributions even in the years when you don’t contribute to the fund. Funds not distributed as grants will continue to be invested by CFNEIA so your charitable dollars can grow tax-free.

Example Graph Above: This scenario shows how a married couple, filing jointly, who typically gives $6,000 a year to charity, can benefit from bunching their charitable donations. This is accomplished by contributing $18,000 to a Donor Advised Fund every three years. In this example, the donors itemize in years one and four and take the standard deduction in years two, three, five, and six. Note: This scenario assumes a quasi-endowed Donor Advised Fund is established and that a minimum $10,000 balance is maintained in addition to the grantable (“bunched”) amount.

If you don’t already have a Donor Advised Fund, we can establish a new fund in one meeting, so reach out to set up a time. Contact our Charitable Impact staff to get more details!

3. Donate Stock: A Tax-Smart Giving Option

Instead of writing a check, consider donating long-term appreciated stock directly to the Community Foundation or your Donor Advised Fund. By doing so, you avoid paying capital gains taxes on the appreciation, allowing you to contribute more to the causes you care about. Please note, there are deduction limits for stock donations depending on your income, so it’s always best to consult with your tax advisor before proceeding.

To ensure your stock donation qualifies for a 2024 deduction, it must be initiated by Thursday, December 19, 2024. Contact us early to make sure we can process your gift in time.

4. Qualified Charitable Distributions (QCDs) from Your IRA

If you are 70½ or older, you can take advantage of a Qualified Charitable Distribution (QCD). This allows you to transfer up to $105,000 from your IRA directly to charity without having to pay income tax on the distribution. It’s a great way to meet your Required Minimum Distribution (RMD) requirements if you are over age 73, while also benefiting charitable causes.

Please note: QCDs cannot be directed to Donor Advised Funds, but they can be used to support other funds at the Community Foundation, such as a nonprofit organization fund. (See a list of our nonprofit funds.) To ensure your QCD is processed this year, it must be initiated before the IRA deadline. Reach out to us as soon as possible to begin the process.

Year-End Giving Deadlines

To ensure your gifts are counted for 2024, please keep these important deadlines in mind:

- Cash or other marketable securities: Transfers must be completed by December 31, 2024. Contact us and your advisor to make sure the transfer is received and processed in time.

- Stock donations: Initiate donations by Thursday, December 19, 2024.

- Donor Advised Fund contributions: Contributions to establish or add to your DAF must be received by December 31, 2024.

- QCDs from IRAs: Initiate QCDs well in advance to ensure they are processed before the year-end deadlines.

*Note: Deadlines may vary depending on your institution. Please work with your financial advisor to confirm the exact processing times.

Looking Ahead: Giving in 2025

While December is the perfect time for year-end giving, don’t forget to think ahead to the new year. As you set your 2025 goals, consider making charitable giving part of your resolutions. Whether you need help with estate planning, want to revisit some of the strategies listed above, or would like to create a more strategic giving plan, we’re here to assist you.

At the Community Foundation, we partner with donors to create lasting community impact. If you haven’t yet found a cause that resonates with you, our team can connect you with local nonprofits and initiatives aligned with your passions. Let us help you design a personalized and impactful giving plan for 2025. Reach out today, and together we can make the new year one of meaningful change.

We’re here to answer your questions and help guide you through the giving process. Contact us today to learn more or get assistance with your year-end giving plans!